Does monday.com Stock Have The Potential For A Tenbagger?

- Stefan Waldhauser

- Aug 17, 2023

- 7 min read

This article is an update of a post on monday.com stock that was first published in November 2022 (in German language only). It was last expanded and updated after the figures for Q2 2023.

I am always amazed at how many exciting Israeli software stocks there are on the Nasdaq. One of these is monday.com stock: The Israelis have been delivering an impressive performance for two years since the IPO in June 2021, despite a weak market environment for SaaS.

The monday.com share has become significantly more expensive since this investment story was first published in November 2022. However, the current price is still close to the IPO price of $155 and more than 50% below the highs reached in late 2021.

The figures just published for Q2 2023 led - as with the figures for the last two quarters - to a double-digit price jump.

For me, an opportunity to introduce you to the cloud stock, which is still far too little discussed:

What is monday.com doing?

monday.com has become popular as a cloud-based project management tool.

An advantage of the monday solution compared to the competition is the great flexibility and user-friendliness. Even non-developers can map workflows and optimize business processes with the help of so-called “building blocks” that help to integrate with many other SaaS tools such as Outlook, Gmail, Zoom, Slack or Dropbox.

As a layman, you can imagine the monday software as a "Lego kit for business software". At least that's roughly the software value proposition. The fact that the reality of the extensive requirements of a larger company looks a little different, at least for the developers among you be clear.

In fact, the monday services, originally aimed primarily at small and medium-sized business customers, are increasingly being used by larger companies as well. Around 1,900 customers are already paying more than $50,000 per year for their Monday subscription, which is 63% more such "Enterprise" customers than just a year ago.

Meanwhile, monday.com is well on its way to evolving from a one-trick pony (project management software) to an agile workflow platform for a variety of applications. For a few quarters, monday has been marketing its own Work OS platform with various ready-made applications not only for project management, but also for CRM, marketing, development and work(flow) management.

A growing community of developers are using the monday API to provide more applications and building blocks to monday's around 200,000 paying customers. In 2022 alone, more than 34,000 (net) customers were added! That's an impressive customer base for such a young company.

It looks like an interesting ecosystem for external developers is maturing here around the monday apps marketplace.

Market and Competition of monday.com

monday.com often is compared with Asana or Smartsheet. The SaaS competition is tough and it is not yet clear which provider will be able to take a leading position in the booming market for agile work management software services in the long term.

The monday.com TAM is according to IR presentation $56 billion in size

monday.com has only been on the market since 2014, making it several years younger than Asana and Smartsheet, which were founded in 2008 and 2005 respectively. This is also why monday.com is still a little behind these competitors with sales of $519 million (2022), but is growing much faster and will at least surpass Asana in sales in the current 2023 financial year.

Thanks to its headquarters in Tel Aviv, monday has considerable cost advantages over its competitors from the USA when it comes to development. As a result, Asana is still burning a ton of cash, while monday.com is well past cash flow breakeven.

monday has great ambitions and wants to present itself as an alternative to established application service providers such as HubSpot.

The first figures for the market launch of the CRM are impressive: In the first half of 2023, the number of monday CRM customers more than tripled to over 8,000.

It remains to be seen whether monday will actually succeed in taking market share from established providers such as HubSpot in the long term: According to a HubSpot partner, monday does some "overselling" with regard to its CRM capabilities.

A number of monday customers would ultimately switch to HubSpot after all, since the monday CRM cannot (yet) meet the high customer expectations. Consequently, the focus of investments at monday 2023 is on the further development of the above-mentioned products.

Despite the functional deficits that still exist, the majority of customers seem to be very satisfied with the monday software. However, the high net retention rate of over 120% (for customers with more than 10 users) has been declining in recent quarters.

Monday.com Business Figures for 2023

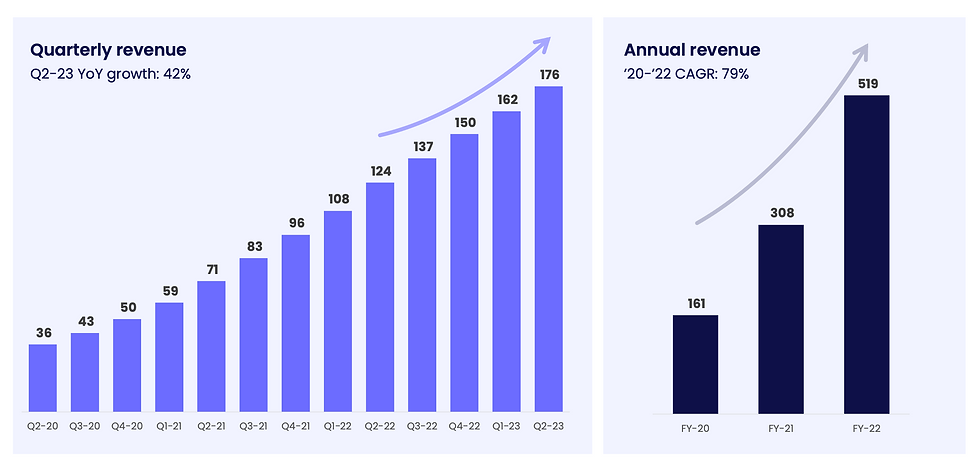

Monday's 2022 sales have exploded by 68% to nearly $519 million. Unsurprisingly, however, growth has slowed down in recent quarters to "only" 42% in Q2 2023.

Nevertheless, these purely organic growth rates are surprisingly high. Because these were achieved despite the gloomy macro environment, which is currently affecting the growth of SaaS application providers.

The development of profitability at monday.com is at least as impressive as the sheer pace of growth.

Monday's gross margin has been impressive since the IPO at a stable >87% (GAAP). SaaS companies with such high gross margins can turn into real cash machines when the market demands it and as soon as the management puts pressure on the cost brakes.

And that is exactly what can be observed at monday.com:

If you take a closer look at the development of operating costs, you will notice that the jump in profitability was mainly due to a reduction in the marketing cost ratio.

monday.com benefits from the fact that the company currently has to spend much less money on online marketing in order to generate sufficiently qualified leads to acquire new customers.

The costs for acquiring new customers via performance marketing are currently falling at monday, as the competition is currently investing less in digital marketing and ads for the relevant search terms are therefore cheaper.

So the company has its operating costs very well under control: As a result, despite the hyper-growth, the lush cash reserves from the IPO 2021 did not have to be touched to any significant extent. The debt-free company sits on $989 million in cash as of mid-2023!

In the first half of 2023, monday.com generated free cash flow of $85 million, the (adjusted) free cash flow margin recently reached 26%.

Together with the sales growth, this means a Rule-of-40 score on a TTM basis of 72%. This is an absolute top value in the current macro environment.

I like that unlike many comparable US IPO stocks, monday already has a truly global business. More than 45% of sales are made outside the US, monday software is available in 14 languages. This means that regional fluctuations can be better compensated for and the high expenses for setting up an international organization are at least partially included in monday's current cost structure.

The monday.com guidance

In February, monday management initially issued cautious guidance for 2023, which provided for a maximum of 34% sales growth. With the presentation of the excellent figures for Q2 2023, this forecast has been increased for the second time and is now expected to grow by 38%, which corresponds to sales of approx. $717 million.

After the optimistic statements on business development in the most recent analyst call, I still assume that organic growth will ultimately be more than 40% again in 2023 and expect sales of at least $725 million

In 2023, according to the new increased guidance, the operating margin at monday should be positive for the first time after -9% in the previous year (non-GAAP) and amount to around 4%. This means that monday has reached break-even two years earlier than planned in the IPO business plan.

This is how times are changing: Now the priorities in the SaaS industry are set visibly differently than two years ago. And that's very healthy.

Does monday.com Stock have the Potential to be a Tenbagger?

Based on my sales forecast for 2023 at the current monday share price of $165, an enterprise value of $7 billion or an EV/sales ratio of around 9.5 is calculated.

Not a bargain, but fair for a SaaS company with a very high gross margin and >20% Free Cashflow margin, which is still growing by more than 35% p.a. (purely organic) even beyond the $500 million sales limit. Personally, I assume that monday.com will already be able to scratch the billion in sales in 2024.

If I'm right - and if profitability continues to develop as positively as it did recently - then the SaaS share from monday.com is still quite attractively valued even after the price increase of the last few months.

Does $MNDY share have the potential to become a tenbagger?

There are many basic requirements:

A big enough market.

A very strong market position.

An attractive cost structure that shows a clear path to rapidly growing profits in the future.

A rapidly accumulating cash flow that could be used to counteract shareholder dilution.

Because a weak point in monday's figures is the dilution of shareholders through high SBC (Share Based Compensation). Since the IPO, existing shareholders have been diluted by 23% through the issuance of additional shares, over the past 12 months the dilution is still 7%. The development of the number of outstanding shares should be monitored in the coming quarters.

For the monday.com stock to become a tenbagger for me, the enterprise value would have to increase to around $50 billion.

To put this into perspective: Salesforce is currently worth over $200 billion, even HubSpot was already trading at almost $40 billion in 2021.

Achieving such a company value in a best-case scenario is actually not unrealistic given the good basic conditions at monday.com. However, there is still a lot to be done and the management would have to act as bravely on the market for a number of years as it has done in recent years.

The attractive market for application software is highly competitive and changing rapidly. Next up are quite disruptive changes due to the new possibilities of generative AI. It will be exciting to see how monday.com performs in this environment with its new AI product features.

Conclusion

I'm thinking year by year with an investment case like this in the cloud application services space. For a tenbagger, a lot of positive things have to come together over the years: e.g. the management would probably have to prove its skills with the first acquisitions. And a significantly higher general valuation level for tech stocks would also have to be reached again.

This is not necessarily to be expected in the coming years. However, I am very optimistic that an investment in monday.com stock will yield a nice double-digit annual return.

If you want to follow the development of monday.com with me in the future, you can Order my free newsletter here now (German Language).

Disclaimer

The author and/or related persons or companies own shares in monday.com. This article is an expression of opinion and not investment advice. Please note the legal information.